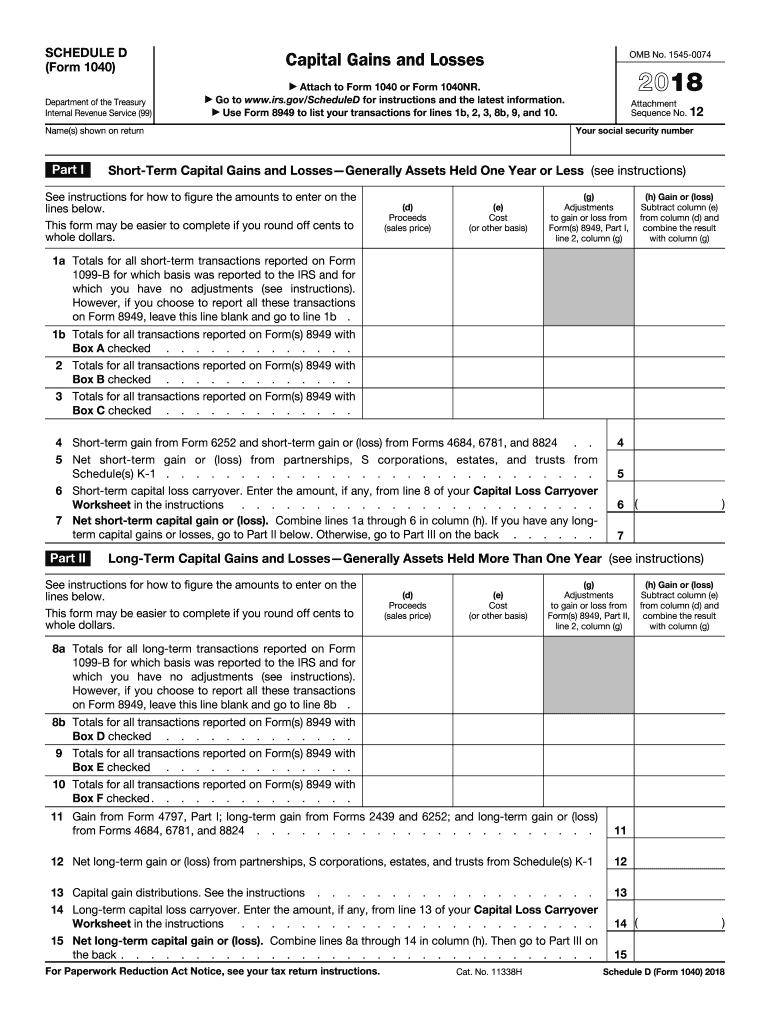

2024 Form 1041 Schedule D Instructions – The 1040 2023 Instructions instruct it during 2023 must use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss on the transaction and then report it on . Buckle up and get ready to report your transactions to the Internal Revenue Service (IRS) on Schedule D and see how much tax you owe. But it’s not all bad news. If you lost money, this form .

2024 Form 1041 Schedule D Instructions

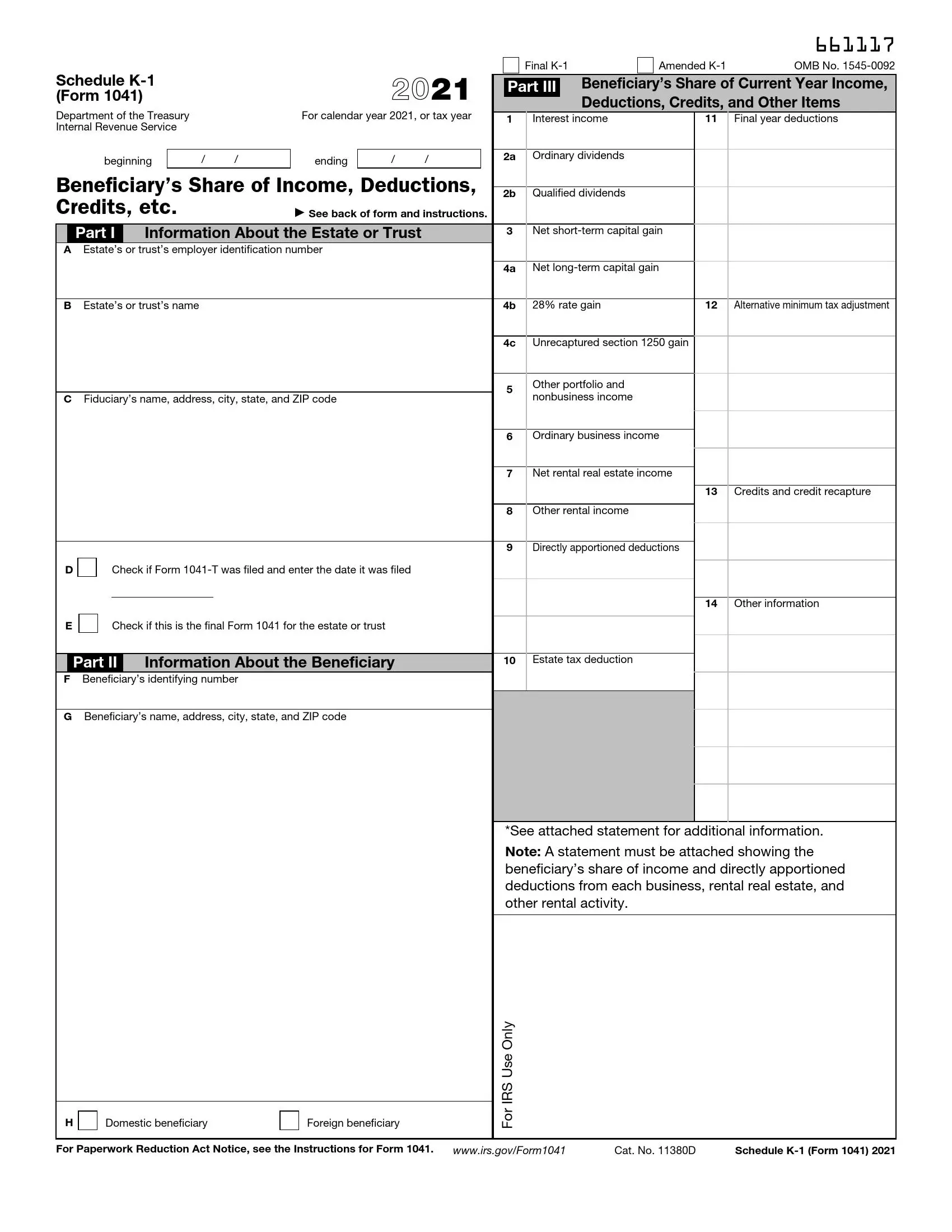

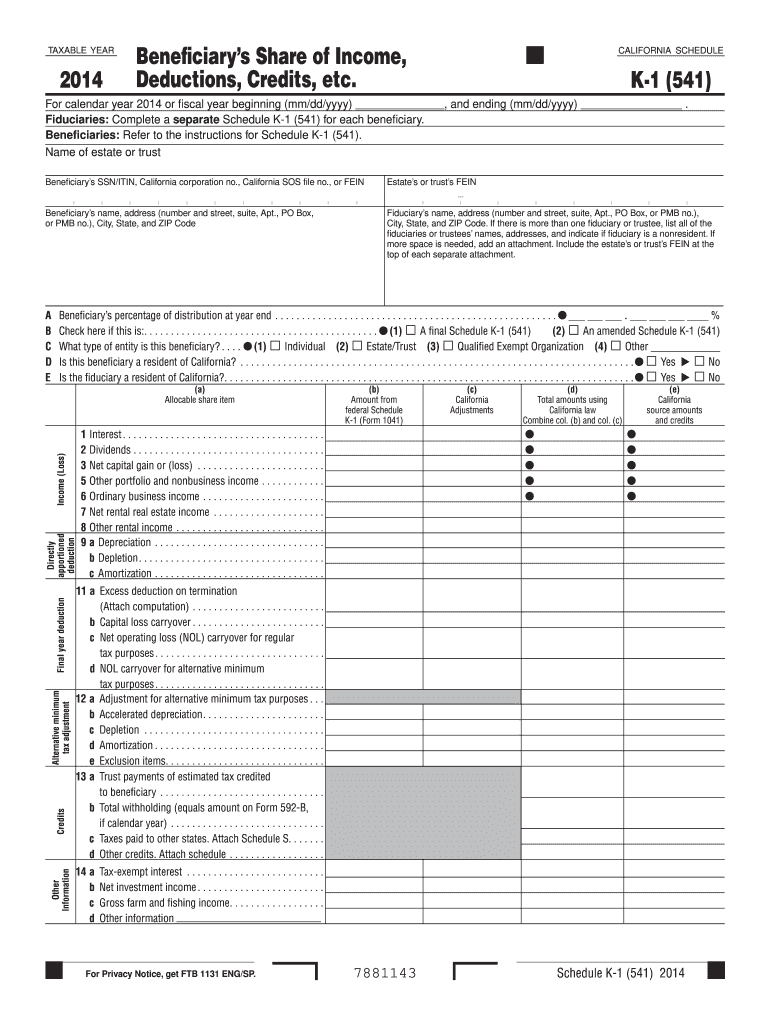

Source : www.nelcosolutions.com2023 Instructions for Schedule K 1 (Form 1041) for a Beneficiary

Source : www.irs.gov1041D120 Form 1041 Schedule D Capital Gains and Losses (Page 1

Source : www.greatland.comIRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comK1 tax form: Fill out & sign online | DocHub

Source : www.dochub.comWhat is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax

Source : turbotax.intuit.comSchedule k 1: Fill out & sign online | DocHub

Source : www.dochub.com1041K1104 Form 1041 Schedule K 1 Fiduciary Return Bond

Source : www.nelcosolutions.comWhat Is IRS Form 1041?

Source : www.thebalancemoney.com1041 schedule d: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1041 Schedule D Instructions 1041K1104 Form 1041 Schedule K 1 Fiduciary Return Bond : Each deposit of checks and money should include a completed Cash Transmittal Form (Figure 1) and two adding machine tapes (or check logs) that reconcile the cash and checks with the receipt form. . This is dependent on which form is being completed, but in general, the emails would come from members of your committee and the graduate program director. If you do not know the members of your .

]]>

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)